Let's talk about how poorly China is doing at the moment

Challenging simplistic views about China's strengths and struggles.

The supreme art of war is to subdue the enemy without fighting

Sun Tzu

I often wonder about those who paint China with a single, negative brush. Many focus on challenges without acknowledging the incredible strengths or the complex realities behind China’s economy - strategic positioning, economic influence, and technological advancement.

The West benefits enormously from a prosperous China: from access to a vast manufacturing base that keeps prices for many goods accessible, to being a massive market for Western companies, and even the innovations in areas like digital payments, commerce, robotics and green tech we can learn from.

Many of our most innovative tech gadgets, the clothes on our backs, and vital components in countless industries often have roots in Chinese manufacturing and innovation.

Frankly, if our kids aren't sewing their own sneakers in a local workshop just to make them affordable, it's partly thanks to the global manufacturing ecosystem China anchors.

The world benefits immensely from their scale and efficiency daily, often without a second thought.

But how “strong” is China, really?

When economists talk about the strength of a country, it often boils down to 4 things :

1️⃣ military, 2️⃣ demographics, 3️⃣ economy and 4️⃣financial health.

Let’s revisit the numbers to see if China is indeed doing so poorly.

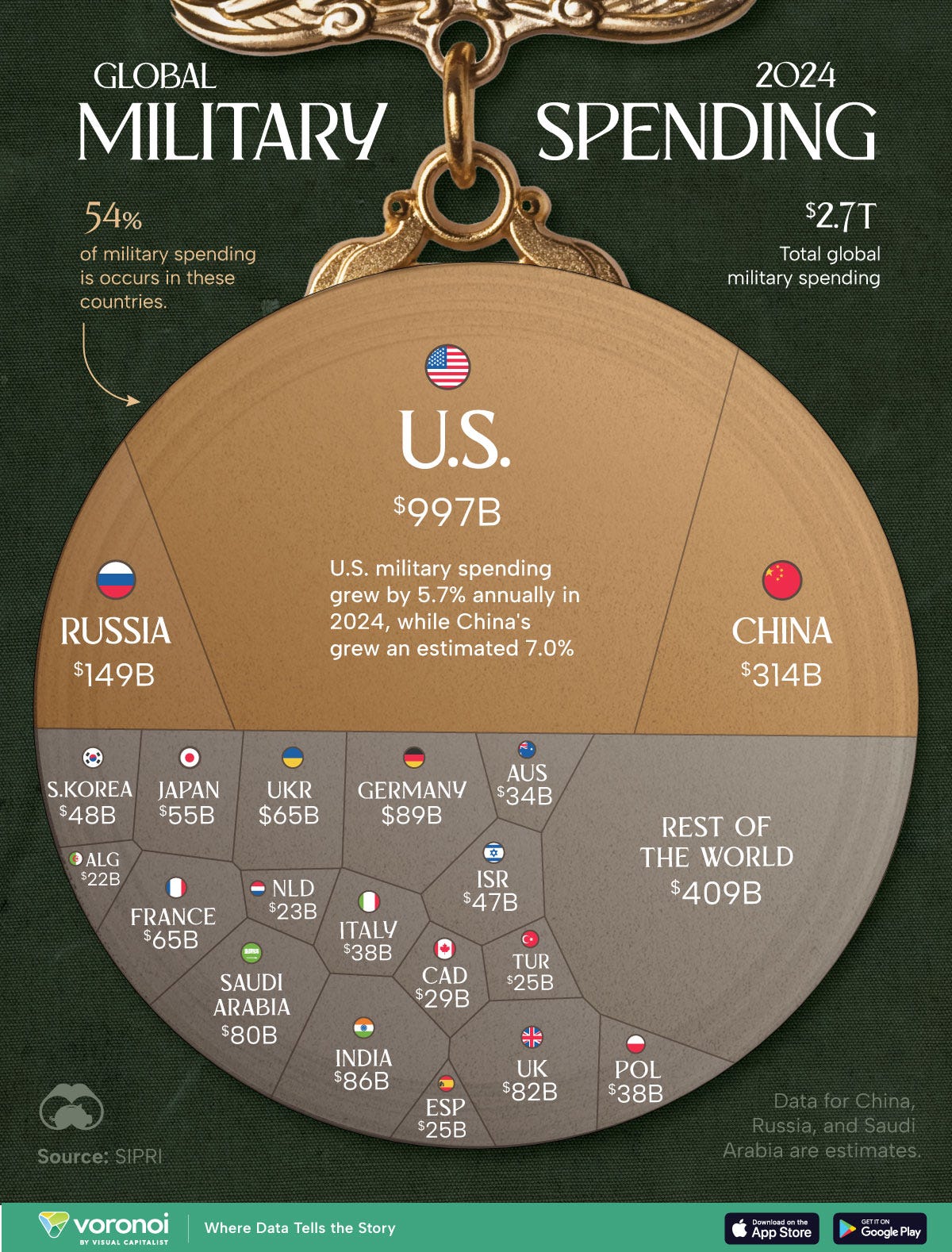

1️⃣ Military

Is China a military powerhouse? Yes.

Their annual spending in USD might not hit US levels, but if you consider their military modernization: they're investing smartly. A Chinese plane might cost $40 million versus a Western equivalent at $200 million for similar capabilities.

If you think about purchasing power parity, their reported military budget - $314bn - could be worth 2 to 4 times that amount in actual equipment, potentially rivaling or exceeding US military capability in certain areas.

China’s focus is also on new hardware, not just maintaining legacy fleets like much of the US - which spends ~40% of its defense budget on maintenance.

That's strategic efficiency.

2️⃣Demographics

Yes, it's a challenge, but for the whole world, not just China. While the West often looks to immigration (a solution with its own complexities and shifting policy), China is leading the charge in robotics and automation.

From factories to everyday services, their investment in robotic solutions is a clear strategy for the future – nobody questions their leadership in advanced robotics.

3️⃣Economy

Despite endless predictions of collapse, they're often still aiming for significant annual growth, around 5% by some measures. Think of the sheer scale of infrastructure they've built and the commodities they consume – numbers harder to manipulate than just GDP figures.

They're navigating a complex transition to a consumer-led economy, and while it's not instant, their consumer numbers have shown resilience.

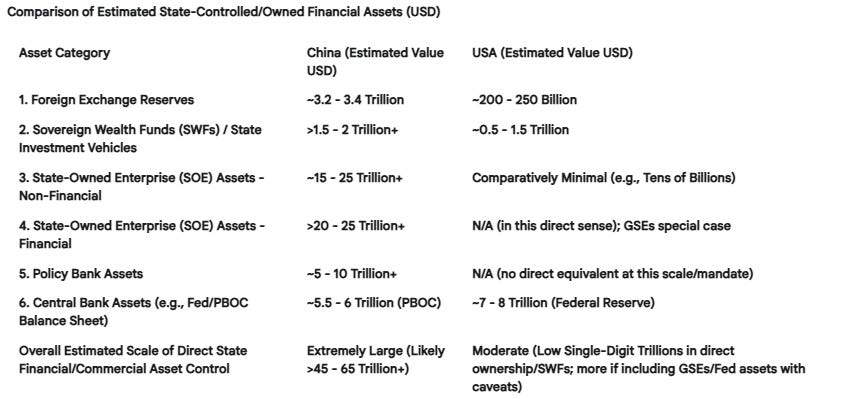

4️⃣Chinese Debt

China's debt-to-GDP (encompassing federal, state, local, household, and non-financial business debt) is generally considered to be around ~290%.

Outsiders often compare it to the US federal debt-to-GDP ratio of around 120%.

Add back state, local, household and non-financial business debt, and that number sits closer to 280% for the US. Pretty comparable on the surface..

The true problem with US debt lies in its servicing cost. To service their debt, the US pays around 6-7% of their GDP in interest on its federal debt, which compares with an estimated ~2.5% for China's overall government debt..

Why? One key difference lies in the nature of the debtor state and its underlying assets.

Unlike the US, where such commercial assets are largely privatized, China's government holds vast assets.

With an estimated $45-65 trillion in state-controlled assets (which could be over 250% of China's GDP), it's understandable why China can borrow at rates around 2% a year.

Conclusion

China is notoriously hard to read, and the level of information to which we have access in the West is often incomplete or curated. Mainly because China does not always want foreign observers to know the full picture.

But the data we can gather paint a different picture from the struggling, “falling-behind-the-US” narrative we often read on papers.

Data actually paints a picture of relative strength and resilience.

It has never paid off to underestimate what you don’t know, especially when assessing a global power."